Table of Content

But if done too aggressively, this approach can compromise savings for other financial goals. And that is not advisable – more so because home loan rates are fairly low if you consider tax breaks on offer. Because this will obviously impact your ability to manage your personal finances, savings for other financial goals and your lifestyle. And everybody has a different expense pattern so it is difficult to say anything in general. So some people will find it comfortable even if they have to pay more than 50% of their income as EMI. Others will find it difficult to pay even 30% of their income as EMI due to higher expenses.

The Federal Reserve has hinted they are likely to taper their bond buying program later this year. Some homes — especially condominiums and town homes — are part of a housing community that includes a community pool, fitness center and other amenities, such as lawn care. If you buy a home in such a community, you will have to pay homeowner's association fees.

Save a bigger down payment to make your home more affordable.

A mortgage is a loan secured by property, usually real estate property. Lenders define it as the money borrowed to pay for real estate. In essence, the lender helps the buyer pay the seller of a house, and the buyer agrees to repay the money borrowed over a period of time, usually 15 or 30 years in the U.S. A portion of the monthly payment is called the principal, which is the original amount borrowed. The other portion is the interest, which is the cost paid to the lender for using the money. There may be an escrow account involved to cover the cost of property taxes and insurance.

What DTI ratio might be comfortable for a family earning $250,000 a year might not work for a family earning $75,000 a year, as financial planning guru Michael Kitces has pointed out. As you can see, there are a number of factors that determine how large of a mortgage you can get. If you get access to your FICO score and crunch some numbers, you can get a rough idea of your borrowing capacity. You can also seek assistance from your bank or a mortgage broker.

Other Factors that Affect How Much House I Can Afford

There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question“how much should my down payment be? Even the mortgage itself has an affect on your refinance rate.

Loan requirements for cash reserves usually range from zero to six months. But even if your lender allows it, exhausting your savings on a down payment, moving expenses and fixing up your new place is tempting fate. Fees depend on how many amenities the community has, how many services it requires, and how much upkeep it needs. Local real estate listings can give you an idea about the homeowners association fees in the neighborhoods, condos or townhomes you’re interested in. Closing costs, which will run you about 2% to 5% of the purchase price, will affect how much home you can afford to a greater or lesser extent depending on how you pay for them.

How Much Will My Monthly Mortgage Payments Be?

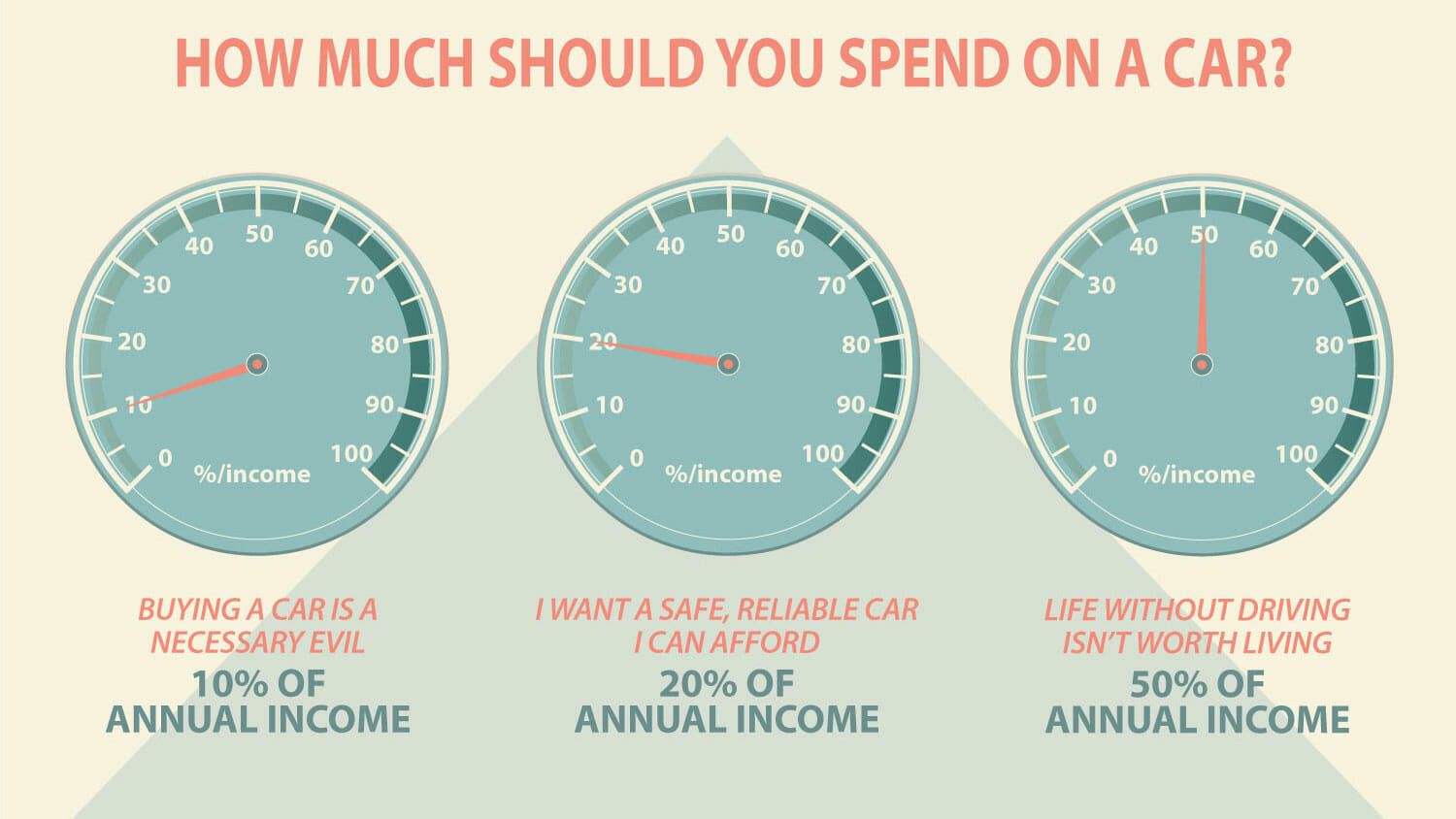

The “three times your salary” rule and the “less than 30% of your monthly income” rule are both helpful guidelines. But the amount you feel comfortable spending on your mortgage payments could differ depending on where you live and your other financial goals. That means determining the interest rate you will be charged.

Rest assured, all homeowners will need to repair or replace a roof, driveway, water heater, or other appliance at some point. But, with most mortgages, lenders will want you to have a DTI of 43% or less. Lenders look at other factors when deciding whether to approve you for a mortgage too, such as your credit score and how stable your job is. PMI is generally required when your down payment is less than 20 percent of the home value. You can avoid a PMI—and reduce your mortgage payment—by saving more for a down payment before signing on the dotted line. A qualification ratio notes the proportion of either debt to income or housing expense to income.

Then there is a case for going for a longer than usual loan tenure of let’s say 30 years. This approach uses a combination of home loan EMI and mutual fund SIP. The savings made on lower EMIs can then be invested every month in something like equity mutual funds SIP– which is expected to do well over long periods. Assuming equity does deliver decent returns, this approach of selecting a longer loan tenure and doing the SIP can help you repay your loan earlier.

This is the level of income a prospective homebuyer makes before taking out taxes and other obligations. Credible can help you find a great interest rate on a fixed-rate mortgage. Start the homebuying process with a budget for your house that works with your current financial scenario. Not only does your salary affect how much you can borrow in a mortgage, it also impacts the types of loans you can take out. Be wary of free credit reporting apps that don’t show FICO scores.

Condominiums, townhomes, and some single-family homes commonly require the payment of HOA fees. Annual HOA fees usually amount to less than one percent of the property value. These are also the basic components of a mortgage calculator. Maybe you can do with a “good enough” home to start and make improvements over the coming years.

Your personal finances aren’t the only consideration that affects the mortgage refinance rates you’re offered. Your house’s value compared to your loan balance also factors into the decision. Monthly payments on a 15-year refinance loan are tougher to fit into a monthly budget than a 30-year mortgage payment would be. However, a shorter loan term can help you build up equity in your home much more quickly.

Then, get loan estimates for the type of home you hope to buy from several different lenders to get real-world information on the kinds of deals you can get. The maximum DTI allowed depends on the type of home loan you choose. For conventional loans, the maximum is 50%, and for Federal Housing Administration loans, it’s between 43% and 50%.

No comments:

Post a Comment