Table of Content

You can also refinance to lower your interest rate or take cash out to pay for large expenses. Other nonconforming loans are aimed at homebuyers who are seen as more likely to default. • Conventional loans require private mortgage insurance if the down payment is less than 20%, but PMI will terminate once you reach 20% equity.

However, some of the conventional loan products can allow a DTI of up to 50%. The amount for a conventional loan must be within the conforming loan limit, which is currently $726,200 in most areas but can be higher in a few high-cost areas around the country. Higher credit scores and higher down payments generally receive the best interest rates.

Guide to Understanding Conforming Conventional Loans

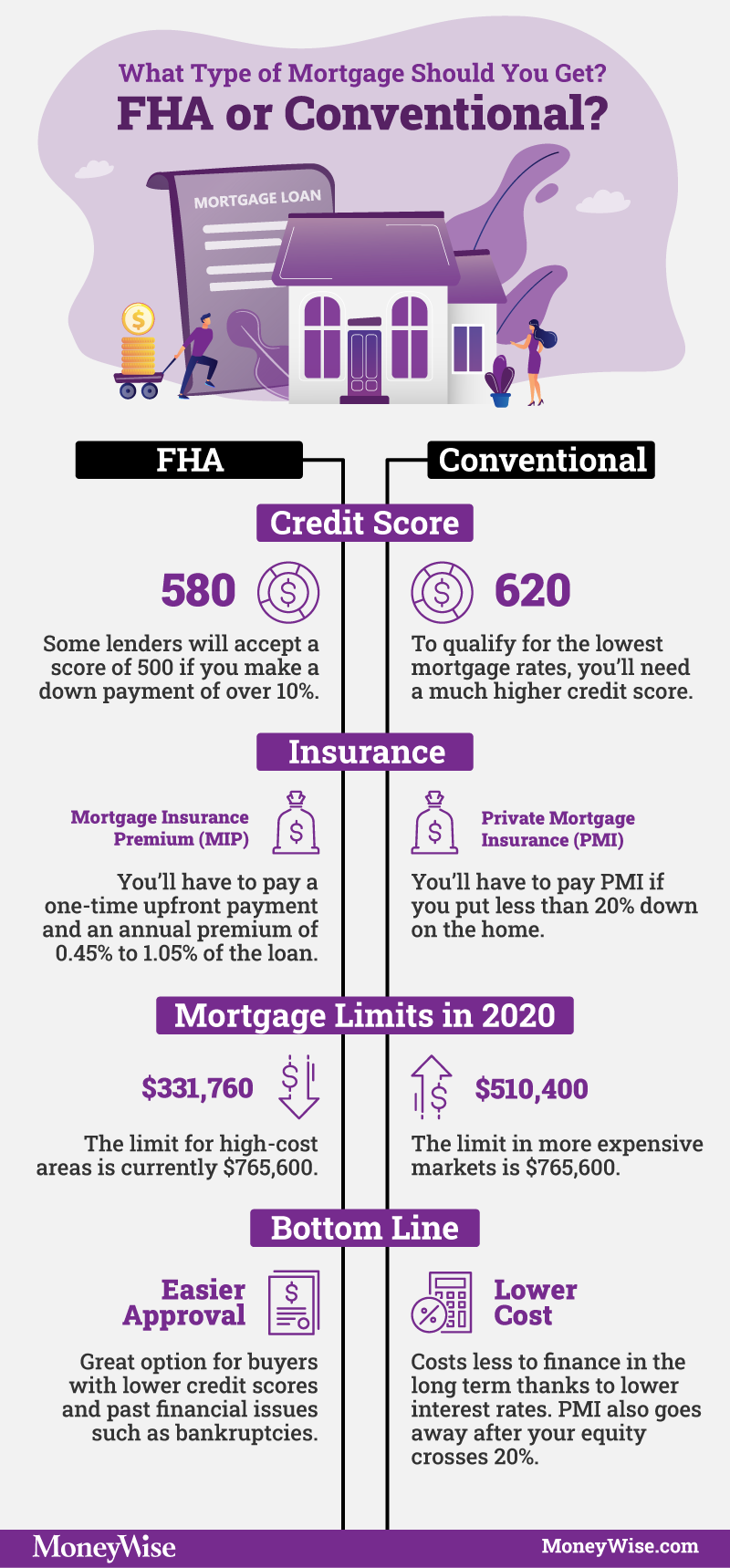

Conventional vs. FHA loans diverge in how these premiums are calculated and applied. With an FHA loan, you have both an upfront premium and a monthly premium. The upfront premium can be rolled into your mortgage or paid at closing; the monthly premium is included as part of your mortgage payment. With a conventional mortgage, you typically only pay a monthly or single premium for PMI.

FHA loans are backed by the Federal Housing Administration, and VA loans are guaranteed by the Veterans Administration. Remember when you first started daydreaming about buying a home? You were probably imagining everything from freshly decorated rooms to a breathtakingly beautiful backyard.

Adjustable rates available

Like other types of mortgages, conventional loan products provide multiple repayment options. Conventional mortgage loans are available in 10,15, 20, 25, and 30-year terms. The monthly payment on loans is higher with the shorter loan terms. Luckily, the fixed-rate 30-year conventional loan is linked to fixed-interest low payments that are still accessible to most home refinancers and buyers.

If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount you're required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income.

Interest Rates for Conventional Mortgages

Your interest rate will also depend on the type of mortgage you have. On the other hand, borrowers with good or excellent credit can usually save the most money with a conventional loan. If your down payment is more than 10%, the mortgage insurance can come off the loan after 11 years. To remove mortgage insurance with an FHA loan, you’ll need to refinance into a conventional loan once you have 20% equity. Like a conventional loan, an FHA loan may require you to pay mortgage insurance with a down payment of less than 20%. You’ll have to pay an upfront mortgage insurance premium , as well an annual one.

PMI can increase your mortgage payments and depends on credit FICO score along with several other factors like DTI. With higher credit scores, lower down payments can offer the PMI option but with minimal effect on total mortgage payment. This allows borrowers to put less money down and still get a payment that works for them.

What Is the Difference Between Conventional and Government-Backed Loans?

Subprime or Non-Qualified Loans – For those with a less-than-desirable credit score or debt record, a subprime loan is often the only mortgage option. In exchange for financing riskier borrowers, lenders usually place higher interest rates and fees on these loans. And while the term “subprime” earned a nasty reputation from the housing crisis, federal law now requires all borrowers to prove their paying ability with mortgages.

We don't own or control the products, services or content found there. Mortgages backed by government agencies offer different qualifications that can make them more attractive to some home buyers. Once you have achieved 20% equity in your property, your PMI can be canceled. • A VA loan must be used for a primary residence; no second homes are eligible.

A seller who doesn’t want to deal with this appraisal process might be less eager to accept an offer financed with an FHA loan than an offer financed with a conventional loan. Conventional mortgages may require less documentation than FHA loans or VA loans, which could speed up the overall processing time. Jumbo loans, which are for home buyers who need to borrow an amount that's higher than the conforming limit for the area. Are guaranteed by the U.S Department of Veterans Affairs and are available only to active service members and veterans.

This level of expertise enables us to anticipate and quickly resolve any issues that might arise and close on time, every time. Enter your email to get connected and notified about our services. Elizabeth Weintraub is a nationally recognized expert in real estate, titles, and escrow. She is a licensed Realtor and broker with more than 40 years of experience in titles and escrow. Her expertise has appeared in the New York Times, Washington Post, CBS Evening News, and HGTV's House Hunters. How To Assess Your Finances And Calculate What To Spend Home Buying - 10-minute read Miranda Crace - October 25, 2022 Home buyers often wonder how much house they can afford.

While efforts are made to verify the information provided, the information should not be assumed to be error free. Some information in the publication may have been provided by third parties and has not necessarily been verified by Guaranteed Rate, Inc. For most mortgages, the amount of financing cannot exceed the mortgage limits set by the Federal Housing Finance Agency. These limits help sustain liquidity and stability in the real estate economy and make mortgages available to a wider range of borrowers. Refer to the chart below to see the conforming loan limits in Colorado by county.

We accept down payments as low as 3% for conforming loans—or with no down payment at all, for buyers who qualify for our Zero Dollar Down Loan. You might find in your search for a loan that other types of loans are more beneficial for you. For example, first-time home buyers, borrowers with more debt, and those with more modest credit ratings may have trouble qualifying for a conventional mortgage. Others who may not qualify for a conventional mortgage include those who have filed for bankruptcy or don’t have cash reserves for a down payment.

As a result, FHA loans have different qualifications and credit requirements, including a lower downpayment. A credit score is a numerical representation of a borrower's ability to pay back a loan. Credit scores include a borrower's credit history and the number of late payments.

Conventional mortgage loans will only require mortgage insurance premiums that are paid monthly if the borrower has put down under 20%. Mortgage insurance on a conventional loan might be lower when compared to a government loan if your down payment is higher and you have a high FICO credit score. A conventional loan is any type of home loan that isn’t insured or guaranteed through a government agency.

No comments:

Post a Comment